Yesterday's TP world

- During design, implemention and maintenance of the company's business model in most cases the company's ERP system is not configured in such a way that relevant intercompany transactional data can be automatically generated or specific high risk intercompany transactions can be monitored realtime.

- Often TP work is a manual process from data gathering through analysis and beyond.

- Many multinationals still save documents on the hard drives of local computers and / or local servers without central access.

- TP process owners have to use MS Word/ Excel and possible SharePoint if there is a central data storage.

- Spreadsheets are usually found at critical points in the audit trail and are often designed by non-specialists with no system expertise. There is most likely no dedicated IT support to the tax function.

- Working with Excel sheets that contain (TP specific homegrown) formulas is risky as for the effectiveness of a control framework you have to rely on work performance and accuracy of your SMEs and preventive and detective controls to manage (e.g. operational) risks.

- Manual processes due to human error increases tax risk - data is manipulated outside the system and need tax controls to properly manage - but causes also workforce inefficiencies as getting access to the relevant transactional data is a cumbersome and time consuming exercise.

- TP adjustments are in the rule done at Year End as a lump sum. Only sophisticated companies have a periodical forecasting process and conduct price adjustments to avoid substantial Year End adjustments.

- TP planning, implementation and periodical assessment(s) are normally done on a profit and not on a transactional basis (consolidated versus individual).

- The inherent risk is in practice often that what has initially designed and contractually agreed is not in line (anymore) with the (current) factual reality. The financial data could disclose what is really occurring from a business model perspective.

For example, more local risks could for example exist due to (new) services, supply of goods, sales support, amount of employees and their skill set / roles.

The new tax world: anticipate what users would want

- Countries are implementing mandatory global tax disclosure statements that for example provide information of entities with legal ownership of IP, entities that have no assets or substance (i.e. holding companies). Such disclosures increases operational compliance tax risks. Central storage and access to this relevant information is required.

- The new reporting trend requires also closer coordination of headquarters that has relevant knowledge of the global ownership of IP and legal structures.

- On January 27, 2016 the OECD issued a press release announcing that on the same day Malaysia signed the Multilateral Competent Authority Agreement on Automatic Exchange of Financial Account Information (MCAA), bringing the total number of signatories to 79.

- The goal is that via the Country-by-Country reporting tax administrations, where a company operates, will get aggregate information annually, starting with 2016 accounts, relating to the global allocation of income and taxes paid, together with other indicators of the location of economic activity within the MNC.

- It will also cover information about which entities do business in a particular jurisdiction and the business activities each entity engages in. The information will be collected by the country of residence of the MNC, and will then be exchanged through exchange of information supported by such agreements as signed today. According to the OECD, the first exchanges will start in 2017-2018 on 2016 information.

- On 28 January 2016, the EU Commission published its Anti Tax Avoidance Package. The package is part of the Commission's ambitious agenda for fairer, simpler and more effective corporate taxation in the EU.

- Questions raised by tax administrations or external auditors could make new audit risks visible and could even result in an audit to assess potentially high risk transactions.

- MNCs should have an efficient governance process in place to manage BEPS queries. A shift in roles and responsibilities within the transfer pricing documentation process is one of the areas that should probably be assessed.

- Many countries are implementing the BEPS recommendation, i.e. master- and local file and CBC reporting due to the new regulations. These regulations will heavily increase the TP compliance work, but will also highlight bugs and errors which were not visible before.

- In addition the EU Commission is challenging countries on their current APA practices

- Realtime monitoring of individual intercompany transactions is a 'must have' to manage tax risks properly. TP is under higher scrutiny and therefore TP teams will put more emphasis on managing the IC prices during the year instead of Year End.

- Besides that it is important that the financial data (still) reflects what has been initially designed and contractually agreed.

Example is an entity which was previously characterized as a contract manufacturer, this means that the entity is only acting on instructions from the HQ. If the financial data show that purchases come from China, resulting in stock provisions on the balance sheet, and FX results because sales is in EU, the transitions will challenge the contract manufacturer status.

- From a tax controversy perspective TP documentation is important and often results in conflicting priorities within the tax function (allocation of budget and tax resources).

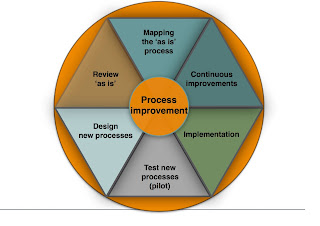

- Better resource allocation and process improvement can be achieved via (semi)automated documentations, configure ERP systems to support TP needs or implement add-on or bolt-on tools.

For example, in the area of data and workflow management, entity charting, document storage, reporting and analytics.

- Tax authorities around the world investing in better tools (data analytics). Some countries want either direct access to systems or have implemented OECD's Tax Audit Files for tax purposes to improve the efficiency of tax audits. The SAF-T is intended to give tax authorities easy access to the relevant data in an easily readable format for both corporate income tax as VAT.

What is the Multilateral Competent Authority Agreement

- The Multilateral Competent Authority Agreement (“the MCAA”) is a multilateral framework agreement that provides a standardised and efficient mechanism to facilitate the automatic exchange of information in accordance with the Standard for Automatic Exchange of Financial Information in Tax Matters (“the Standard”). It avoids the need for several bilateral agreements to be concluded. The text and signatories of the MCAA can be found here.

- Its design as a framework agreement means the MCAA always ensures each signatory has ultimate control over exactly which exchange relationships it enters into and that each signatory’s standards on confidentiality and data protection always apply.

- The legal basis for the MCAA (which is agreed at competent authority level) rests in Article 6 of the Multilateral Convention on Mutual Administrative Assistance in Tax Matters (“the Convention”) which provides for the automatic exchange of information between Parties to the Convention, where two Parties subsequently agree to do so.

Read more: Transfer pricing: surviving the new tax world